Your Location-Based Data Practice: To Build or Buy? The Pros and Cons

By Mark Ailsworth

Leveraging data has become the norm for marketers these days. In fact, there really aren’t many marketing functions that don’t require a data investment. Whether it’s for consumer research for media planning, audience targeting, measuring campaign effectiveness, or optimizing performance, marketers are using data for everything.

One of the most valuable datasets for marketers—and an absolute must-have for location-based businesses—is mobile location-based data (LBD). As soon as consumers started carrying GPS-enabled smartphones a decade ago, data companies saw the opportunity to track consumer movement patterns at scale. It can help brands better understand who is coming to their physical locations, from how far away they are coming, how that compares to their competitors’ locations, and if their local advertising efforts are working to drive visits and sales.

Today, LBD has become invaluable data for any location-based business and there probably isn’t a company out there with significant foot traffic that isn’t already either buying it or renting it.

Location-Based Data: to build vs buy—pros and cons

When it comes to location-based data—or really any kind of significant marketing dataset—there are generally two options open to brands: building or buying. Each has its positives and its negatives.

Building location-based data

“Building” your location-based data practice in this context means that it is your team that handles the processing of a (relatively) raw data feed. While this gives your data scientists and analysts the best opportunity to configure it for your company’s individual needs, it can be very time-consuming and often an extremely costly approach.

Pros of building: Data can be best processed for how the company needs it.

In most instances, data professionals prefer raw data because they get it before anyone else has touched it and is usually at its most granular state. If configured by a third-party, the data might be more immediately actionable, but that’s generally because it has been processed and filtered for either a very singular, very specific use-case or a generic, one-size-fits-all way to handle any use case. In its processed state, your data team can’t “go backwards” if for some reason the refined data doesn’t have the granularity they need to develop new use cases to unlock the value of the data investment.

However, by handling the processing themselves, a company’s data team can configure it best for the use case(s) for which they are intended. If there are unique subtleties for who the data needs to be filtered for the business, then the data team can account for those rather than “buying off the rack” from third-party processors. This gives your company the most flexibility with regard to how it can find ways to use the data.

Cons of building: Marketers have to process it themselves = expensive and complex.

While many companies see the value of building their own team and method of processing raw, location-based data, the reality is that to achieve this flexibility can be an extremely complex and expensive solution.

To better understand this, one needs to consider what goes into this approach. The complexity of these steps should not be underestimated.

- Data ingestion is required to get the raw data into your systems in a digestible format, with a sizable storage system to house it securely.

- Filtering is needed to ensure that the signal is separated from the noise. And there’s a lot of “noise” in location-based data. Sometimes devices tied to a location are from employees or vendors which can skew the final analysis. With the multi-meter accuracy of GPS, there are also plenty of false-positives and anomalies to handle. For example, locations inside heavily trafficked areas like shopping malls, airports, or military bases. How does one know that a particular mobile ID visited their location and wasn’t there to shop at a store nearby?

- Integration of other datasets including a company’s own proprietary data or other purchased datasets that can greatly increase the value of LBD when merged.

- Meaningful segmentation must be applied before it is handed off to marketers.

Also, data scientists and analysts aren’t cheap and the tools needed to analyze it could have a cost too. And with analysts—either in-house or external consultants—you have the added complexity of the human element. People get sick, take time off, or quit. When these things happen, the expertise walks out of the building with them and operations are on hold until someone can fill the void; and then there’s the ramp-up period needed for them to become familiar with the dataset itself.

Why burden your analytics team down with the processing when you need them to handle the important tasks of analyzing the data and getting it to the teams that need it.

Buying location-based data

Buying data can be done in a few different ways, taking you to various points of a complete solution. One way is to buy it through a third-party processor who does the heavy lifting for you so that your data team can spend their hours on the last mile of configuring that the data will need for your company to be able to use it.

Another way is to “buy” it from a point solution vendor (i.e. for targeting, measurement, competitor insight, etc.) that handles the processing needed for its individual use case. For example, an audience targeting partner could offer location-based audience segments that can be used as part of a programmatic buying platform. The cost of the location-based data is then included in the cost of audience segments.

Pros of buying: It’s easy and immediately actionable.

By buying, you don’t have to worry about handling the data heavy-lifting—the entirety of the data configuration and processing is performed by the partner. That means no worries about how to ingest or filter it. Third-party processors can help companies that are new to using location-based data to get the stream in an easy-to-use manner.

With point solutions, the location-based data is processed by them to best match the use case for which it is needed. For example, a measurement partner using location-based data on your behalf will process it in a way that fits its particular measurement philosophy.

Cons of buying: Extremely less flexibility and not being able to unlock its true power.

While buying location-based data is a turn-key option, the downside is significant. The challenge with this is the aforementioned issue that third-party processors generally offer an off the rack configuration solution that may not fit your company’s needs. Yes, if you have a very specific use case in mind, you can evaluate the vendor’s process to see if it fits your needs. Or you can go with a point solution for their offering, but in either case, you are locked into that configuration.

Location-based data is a strategic asset for location-based companies. It shouldn’t be seen as let’s just use it for X use case, it should be viewed as something that can continue to be harnessed and leveraged for a variety of use cases—the way you use this dataset can be your unique, competitive advantage in the market. By buying it off the shelf you are just doing what any other of your rivals can do. You aren’t being strategic and LBD is simply too important of a resource for location-based businesses to not maximize.

Option #3. Segmented location-based data for all use cases

So, building LBD means you have the flexibility to figure out unique and strategically advantageous use cases, but the downside is that your team does all of the heavy lifting. And buying it might be turn-key, but you only get a small slice of the potential that this dataset has for your business.

Those are the most common options for marketers. But now there’s a third option.

Marketers have to deal with so many different datasets these days that they can’t handle it all themselves. There’s a new category of data partners that are emerging that are experts in specific data sets, can be an extension of your team with innovative tools already built to ingest the marketer’s data purchase, and can enable multiple use cases at once.

Garnter calls these new, powerful partners augmented analytics and says it’s the future of analytics.

simMachines is this kind of company for location-based data.

personifyAI by simMachines is part processing partner, part segmentation engine. We are experts in processing raw location-based data to filter out the noise from the signal based on how your analyst team needs it. Our team knows the ins and outs of how LBD is collected, what the anomalies look like, and how best to process this unique dataset.

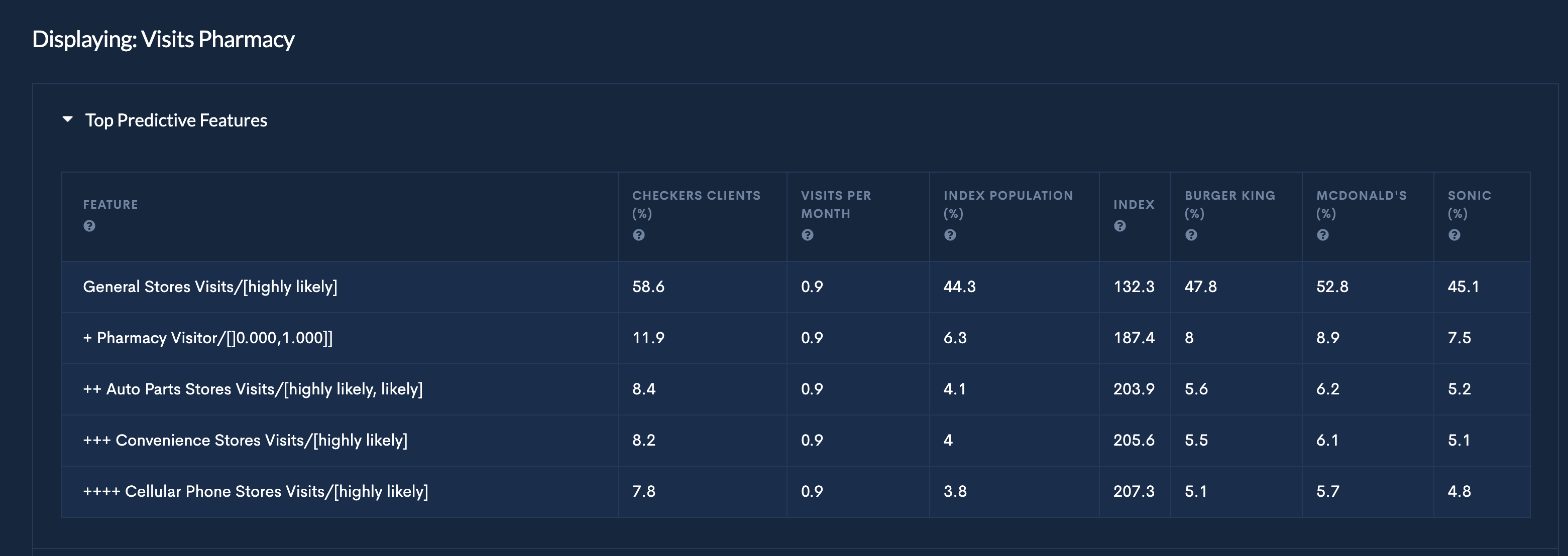

Then, it’s taken through our AI-driven dynamic predictive segmentation engine to cluster your audience into meaningful audience groups based on a propensity to drive your business goals. Dynamic predictive segmentation is simMachines’ secret sauce and the future of how marketers will approach segmentation.

We work with your analysts to understand how they might configure location-based data themselves if they had the time and resources, and then we deliver it exactly how they want it so they can take over and apply the real value they bring.

Think of it this way: location-based data is crude oil and personifyAI is the best refinery on the market.

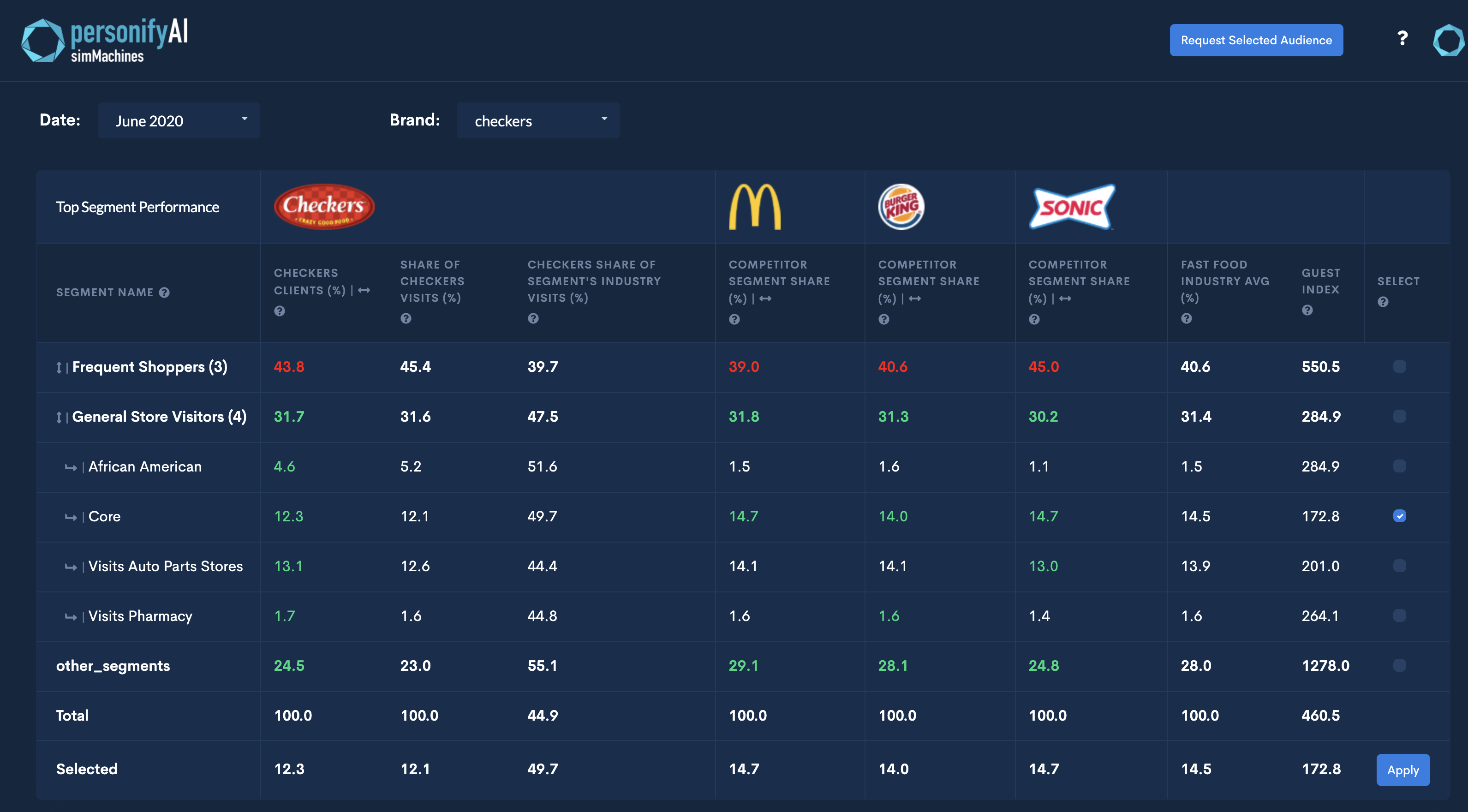

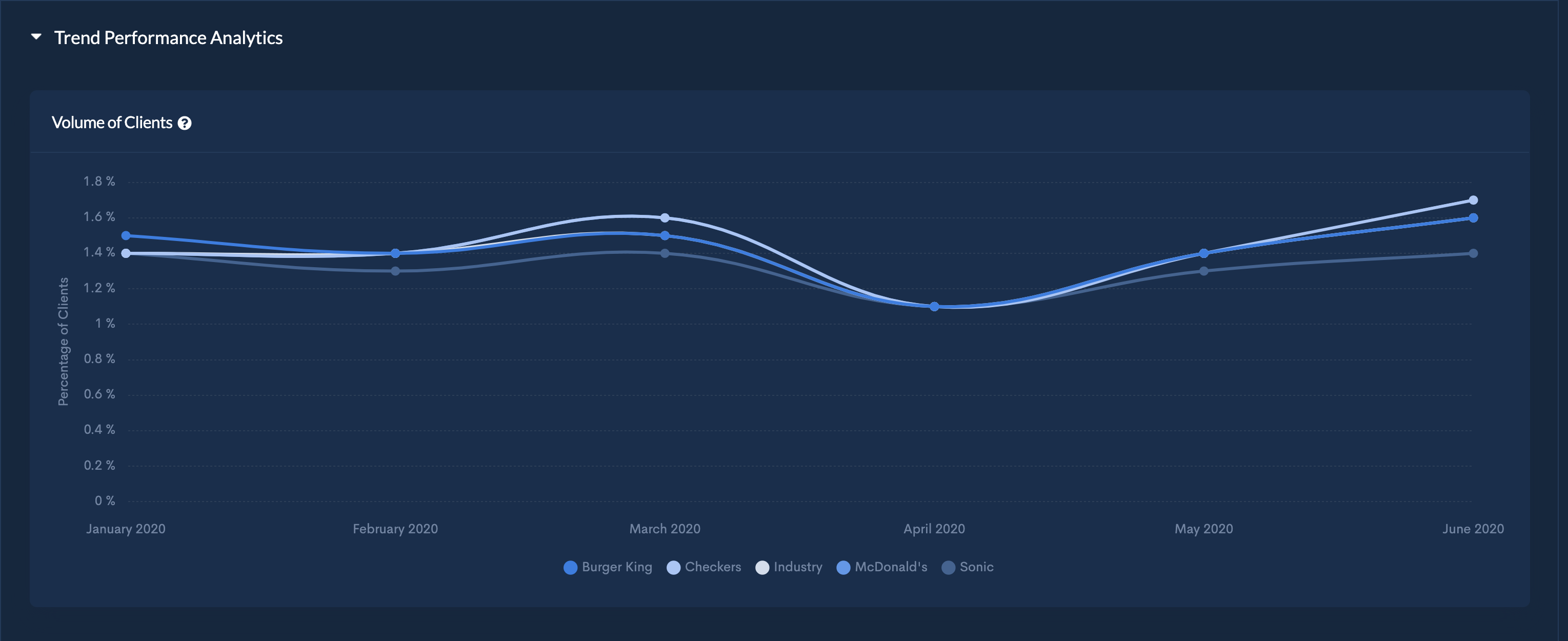

And all of this activity can be tracked inside personifyAI’s beautiful, intuitive dashboard. I know this is going to sound like a pitch, but many marketers have told me that if they could build the most useful dashboard for their location-based dataset, it would look and function just like personifyAI.

view competitor intel side-by-side on personifyAI’s main dashboard

dive deep into segment-level visitation data

trend reports for insight-building

Location-based data (LBD) is a strategic asset for location-based businesses

It’s not just another data investment. The power of LBD to transform marketing performance for location-based businesses is simply too important for marketers not to be squeezing every bit of value from it.

While in the past marketers have taken a build or buy approach to harnessing data, there’s a new option that builds upon the strengths of owning but addresses the issues of processing it yourself. It offers the immediate actionability of buying, but offers the flexibility of building. And it costs marketers a lot less than either option.

Is your company treating your location-based data as a strategic asset?

If not, let’s chat. Here’s my email address: markailsworth@simmachines.com.

Let’s talk about how location data + segmentation can be a game-changer for your business.